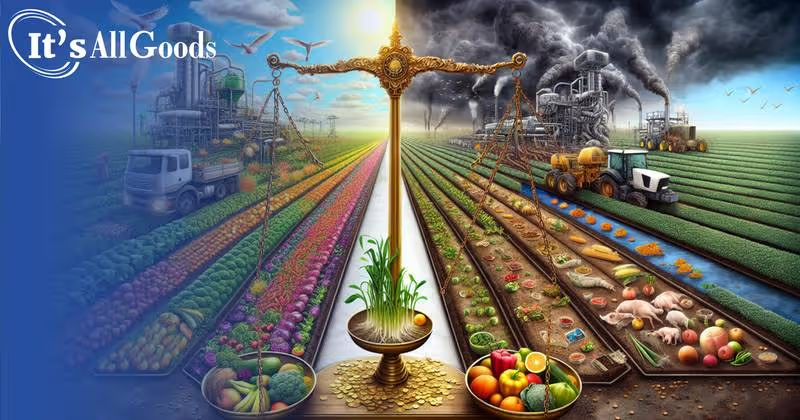

he global food system faces unprecedented challenges, with food sustainability issues at the forefront of concerns for governments, businesses, and consumers alike. As the world grapples with climate change, biodiversity loss, and growing populations, the need to implement sustainable food systems has become increasingly urgent. From farm to fork, every aspect of food production, distribution, and consumption has an impact on the environment, economy, and society, making it crucial to address these interconnected issues.

This article delves into the financial hurdles hindering sustainable food systems and explores potential solutions. It examines the current state of food system financing, identifying key challenges such as limited access to capital for small-scale farmers and the high costs associated with transitioning to sustainable agriculture practices. The discussion also covers innovative financial solutions, including impact investing and green bonds, which are emerging to support sustainable food initiatives. Additionally, the article analyzes the role of policy in driving sustainable food finance and highlights examples of successful sustainable food systems from around the world.

The global food system is facing significant challenges, with hidden costs and misaligned incentives contributing to unsustainable practices. This section examines the current state of food system financing and the obstacles hindering progress towards more sustainable models.

Today's food systems generate a staggering USD 12 trillion in hidden social, economic, and environmental costs . These hidden costs, equivalent to about 10% of global GDP or USD 5.00 per person per day worldwide, are not reflected in the prices consumers pay at checkout counters. The true cost of food production includes environmental degradation, health impacts, and social inequities that are often overlooked in traditional economic assessments.

Despite the urgent need for sustainable food systems, there is a significant underinvestment in practices that could address these hidden costs. Most of the USD 600.00 billion in global public financial support for agriculture and fisheries contributes to the overuse of natural resources and often benefits larger farmers over smaller ones. This misallocation of resources perpetuates unsustainable practices and hinders the transition to more environmentally friendly and socially equitable food systems.

The current food system incentivizes unsustainable choices, prioritizing volume over nutritional value and short-term profits over long-term sustainability. Public policies often fail to penalize or may even promote the production and consumption of less nutritious or harmful foods, at the expense of nutrient-rich, diversified diets. This misalignment of incentives creates a significant barrier to implementing sustainable food practices and addressing the hidden costs associated with the current system.

The transition to sustainable food systems faces several financial hurdles that impede progress. These challenges range from limited access to capital for small producers to the complexities of risk assessment and management in an increasingly volatile environment.

Small-scale farmers and producers often struggle to secure the necessary capital to implement sustainable practices. The current financial landscape prioritizes volume over nutritional value and sustainability, creating barriers for those looking to adopt more environmentally friendly methods. Many farmers interested in sustainable practices face economic obstacles to implementation, as the upfront costs can be prohibitive. To date, agriculture represents only 22% of the blended finance market globally and makes up less than 10% of total financing volumes, indicating a significant gap in funding for sustainable agricultural initiatives.

The food sector is increasingly exposed to risks that can destabilize both public and private sector portfolios . Climate change, biodiversity loss, and other environmental factors contribute to the inherent volatility of food markets . Economic risk is particularly pronounced for producers who may not be producing high-value products and must absorb environmental risks such as droughts, floods, or pests. This volatility can lead to significant economic losses for farmers, especially in years of extreme weather events .

To address these challenges, there is a growing need to change how risk is assessed and integrated into financial decision-making . Investors and large businesses can adopt and report against the Taskforce on Climate Related Financial Disclosures and help develop the Taskforce on Nature-related Financial Disclosure . Additionally, innovative risk-sharing mechanisms are being developed to target specific risks associated with the adoption of new conservation practices .

One of the key challenges in sustainable food financing is balancing short-term financial pressures with long-term sustainability goals. Many sustainable practices require initial investments that may not yield immediate returns, making it difficult for farmers to justify the transition. Pay for Performance programs offer an alternative approach by incentivizing farmers for the environmental outcomes they provide, such as reducing greenhouse gas emissions and improving water quality. This approach offers tangible incentives for practices that may not provide an immediate return on investment but contribute to long-term sustainability.

Blended finance has emerged as a powerful tool to address the substantial funding gap in sustainable food systems. This approach strategically uses development finance to mobilize additional private investment towards sustainable development in developing countries. The core objective is to deploy development-focused funds to attract private investors to opportunities they would otherwise overlook, thereby increasing the volume of finance for sustainable development .

According to Convergence, the global network for blended finance, since 2015, an average of 13 blended transactions per year have targeted agriculture, accounting for around USD 1.20 billion in financing annually . Overall, 146 blended transactions have targeted the agriculture sector and/or SDG 2, representing aggregate financing of USD 13.40 billion.

Green bonds and sustainability-linked loans (SLLs) have become crucial financing tools for companies pursuing sustainability initiatives. Green bonds are corporate debt instruments used to fund projects with positive environmental or climate effects. The International Capital Market Association established the Green Bond Principles, which provide voluntary guidelines to promote transparency and integrity in the green bond market.

SLLs, on the other hand, incentivize borrowers' commitment to sustainability by linking improved sustainability performance to lower-cost financing. In these arrangements, if the ESG rating or other sustainability performance target improves, the interest rate decreases .

Impact investing in sustainable agriculture offers intriguing opportunities for those seeking to generate attractive returns while creating positive social or environmental impact. The organic product market has shown significant growth, with U.S. organic product sales soaring by 12.4% to nearly USD 62.00 billion in 2020.

Impact investors can support grassroots efforts that have the potential to transform agriculture and uplift entire communities. By providing capital and support, these investments can help farmers modernize their practices, increase productivity, and implement sustainable farming techniques.

Governments play a crucial role in shaping sustainable food systems through policy interventions. Currently, agricultural subsidies, averaging USD 600.00 billion annually in countries generating two-thirds of global agriculture, are not effectively supporting sustainability goals. Only 5% of this funding supports conservation objectives, while 70% goes to pure income support. To address this misalignment, governments should redirect subsidies to promote sustainable practices. For instance, Brazil successfully reduced deforestation by conditioning low-cost agricultural loans on forest protection.

The introduction of mandatory sustainability reporting frameworks, such as the Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting Standards (ESRS), is driving change in the food and beverage industry. These regulations require companies to provide standardized, comprehensive data on their sustainability performance and climate risks. For many food and beverage companies, Scope 3 emissions, which include those from farmers in their supply chain, constitute an average of 89% of total emissions.

Public-private partnerships (PPPs) are emerging as potential vehicles for realizing public health nutrition goals while stimulating private investment. These alliances aim to achieve common goals benefiting societies and all partners. However, nutrition-related PPPs face challenges, including opposition and limited evidence of effectiveness. Despite these obstacles, PPPs can facilitate dialogue between government policymakers, industry stakeholders, and civil society organizations to develop evidence-based policies promoting sustainability, resilience, and inclusivity in the agricultural sector.

The global food system faces significant sustainability challenges, primarily due to hidden costs, misaligned incentives, and financial hurdles that hinder small-scale farmers from adopting sustainable practices. These hidden costs, totaling USD 12 trillion annually, are not reflected in consumer prices and include environmental degradation and health impacts. Financial barriers such as limited access to capital and the complexities of managing risks related to climate change further complicate the transition to sustainable agriculture.

Innovative solutions like blended finance, green bonds, and impact investing are emerging to support sustainable food systems by mobilizing private investment and incentivizing environmentally friendly practices. Additionally, government policies, including realigning subsidies and implementing mandatory sustainability reporting, play a vital role in promoting sustainability and holding companies accountable for their environmental impact. Collaborative efforts between public and private sectors are essential to addressing these financial challenges and advancing global food sustainability.